This reviews how macroeconomics has approached the possible introduction of retail CBDC. A review of the literature reveals that macroeconomic models of CBDC often rely on CBDC design features and narratives which are no longer in line with the one of central banks actually working on CBDC.

Digitalization is making its way into payment transactions and motivates discussions about CBDC

The digitalization of large parts of everyday life and of the economy also extends to payment transactions. In the euro area, for example, the share of cash payments at the point-of-sale (i.e. in physical shops) declined from 79% to 59% between 2016 and 2022, mainly for the benefit of card payments.1 If this trend continues or even accelerates, the role of cash and thus central bank money would decrease significantly for the benefit of private payment service providers. This also raises concerns about insufficient competition, inclusiveness, privacy protection as well as strategic autonomy of sovereign states.

Against this backdrop, a growing number of central banks started to prepare for the issuance of CBDC (for example the People’s Bank of China in 2014, the Riksbank in 2016, India in 2017, and the ECB in 2019). The envisaged design features of retail2 CBDCs that consistently emerged across these CBDC projects include non-remuneration and limitation of holdings. By issuing CBDC, central banks want to preserve the benefits for citizens of the co-existence of central bank money next to commercial bank money (more choice for citizens and merchants, preventing abuse of market power by few dominant private firms since payments have strong network effects, preserving the anchoring of all forms of private money in an effective convertibility promise into usable central bank money) and modernizing central bank money available to citizens by allowing the advantages of electronic payments (integration into mobile phone; overcoming the need to warehouse cash in a separate wallet; reducing risk of theft; overcoming costs associated to cash including higher environmental footprint) to also benefit central bank money and not only commercial bank money.

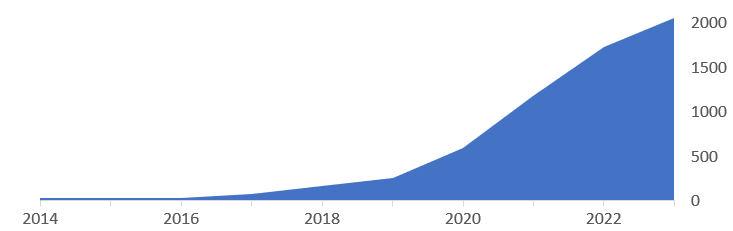

In parallel to the actual work of central bank payment experts, a heated academic debate about CBDC began in 2016. Due to the growing number of papers that present macro-economic models examining CBDC (figure 1) and, on the other hand, quite detailed plans by central banks to issue CBDC, our new paper (Bindseil and Senner, 2024) examines to what extent the assumptions and scenarios contained in these macroeconomic models of CBDC correspond to the objectives and emerging design choices communicated by central banks and related to this, how applicable the papers’ predictions of macroeconomic effects are to the CBDCs outlined or announced by central banks. The choices to be made with regards to the issuance and design of CBDC are of high importance for society, and central bankers and legislators want to understand what is at stake. It is therefore logical that both also turn to academic literature on CBDC with the assumption to find relevant predictions regarding macro-economic effects, and that both also consider basing their choices on the conclusions of this literature.

Figure 1. Number of new papers with CBDC models (annual, 2014-2023, source: Google scholar)

What central banks have announced on CBDC design

In principle, a variety of CBDC designs could be compatible with the motivation of central banks to preserve the role of central bank money in payments, including the introduction of potentially unlimited, large-scale or remunerated CBDC. When CBDCs first started being discussed in 2015/2016 by central bank researchers (such as Barrdear and Kumhof, 2016/2021), uncertainty about these design features was high and central bank payment departments had not yet worked on the actual specifications of CBDCs. As payment experts progressed in their work and central banks started unveiling their actual plans, however, this uncertainty gradually dissipated. In this sense, it is natural that early academic research work on the topic features some hypothesized characteristics of CBDCs that do not coincide with the designs that were worked out by payment experts and endorsed by the central bank decision makers. When considering the issuance of CBDC, central banks have been particularly careful with regards to unintended consequences of CBDC, while they showed little appreciation for the positive economic effects that research papers considered possible through remuneration or via some quantity effects if CBDC holdings would be large. Central banks essentially approached the design of CBDC in a way to preserve, and not to expand the relative role of central bank money in the economy. Therefore, they also opted against using CBDC for extending their footprint on the economy at the expense of banks and thereby went against those who favored the idea to use the issuance of CBDC to move towards a “sovereign” monetary system....

more at SUERF

© SUERF

Key

Hover over the blue highlighted

text to view the acronym meaning

Hover

over these icons for more information

Comments:

No Comments for this Article